|

| 1944 "She" magazine with Vivien Kellems on the cover. From the collection of The Vintage Purse Museum. |

Vivien Kellems (1896-1975) was an inventor and businesswoman who refused to collect withholding taxes from her employees, saying it was double-taxation and unconstitutional. It's unclear what her opinion was on the 20 percent US federal excise "luxury" tax on many women-centric items, but it's interesting to note that on the same day the handbag tax went into effect, there was a smear campaign against Miss Kellems, linking her to a boyfriend who was allegedly a Nazi spy.

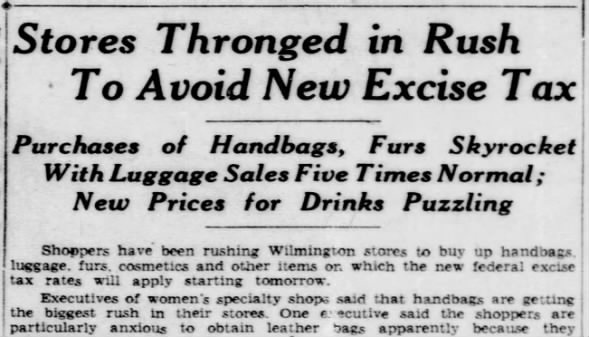

The 1944 newspaper clip below shows the news about the newly implemented luxury taxes and a separate article about the Kellems' rumor, later disproven.

Vivien Kellems challenged taxation policies until her death, but remains an icon of the fight against unfair taxation. Among her most memorable quotes is, "Our tax law is a 1,598-page hydra-headed monster and I'm going to attack and attack and attack until I have ironed out every fault in it."

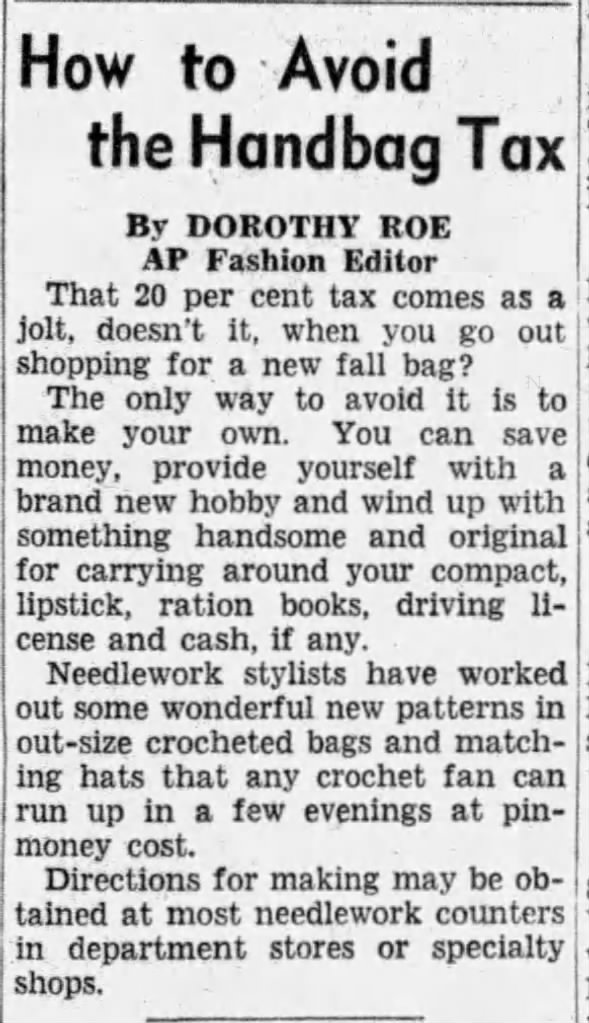

01 Apr 1944, Sat Rutland Daily Herald (Rutland, Vermont) Newspapers.com

01 Apr 1944, Sat Rutland Daily Herald (Rutland, Vermont) Newspapers.com